To create a more equitable energy system, utilities need a better understanding of historically underserved customers and communities. Utilities can use market research to accomplish this, especially when the research is conducted with equity in mind.

At E Source, the goal of conducting market research is to understand customers’ energy-related needs, behaviors, and beliefs. We can then segment our data based on demographics and geography to understand the customers in your service territory most in need of energy assistance. In turn, this helps you understand who these customers are, what programs they’re mostly likely to consider, and what help you can provide. When you hear directly from your customers you can design truly equitable programs to meet their needs.

How market research can help you understand your customers

There are many ways you can use market research to better understand and create equitable programs for your customers. One way is to conduct surveys asking for customers’ opinions on particular topics.

For example, we know that beneficial-electrification programs focused on electric air-source heat pumps can replace almost all heating fuels with electricity, a cleaner fuel. In our report Which customers are ready for heat pumps? available to members of the E Source Distributed Energy Resource Strategy Service, we share how households making the switch will save money on their utility bills while reducing carbon emissions. Despite these benefits, utilities face challenges in encouraging customers to switch.

To better understand this challenge, we conducted the E Source 2021 Residential Electrification Survey, to learn about:

- Residential customers’ perceptions of electrification technologies

- Their readiness for these products

- The kind of equipment they currently have in their homes

Through the study, we learned that when there’s an immediate need to replace a broken appliance, respondents consider the cost to be most important, followed by the speed of replacement.

And through conversations with utilities, we learned that if customers’ homes aren’t properly wired with capable electrical panels to effectively manage new electrification loads, they’ll likely choose quick, fossil-fuel-burning alternatives over a heat pump. Members of the Distributed Energy Resource Strategy Service can learn more in our report How to prepare single-family homes for electrification.

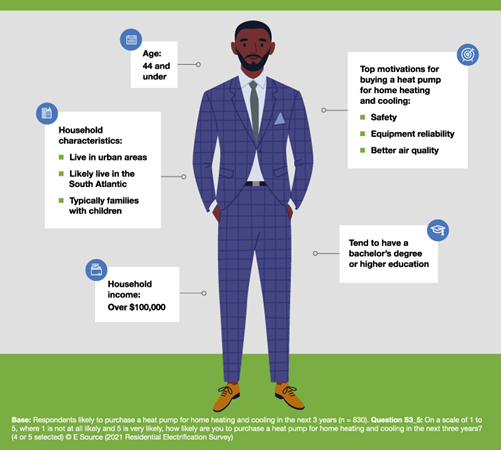

Understanding your customers is an important part of designing effective electrification programs and services. Our market research helps you engage with your customers and understand the market for electrification technologies in your service territory. For example, customers who are likely to purchase a heat pump for home heating and cooling in the next three years are typically younger than 45, have at least a bachelor’s degree, and live in urban areas (figure 1).

Figure 1: Customers likely to buy a heat pump in the next one to three years

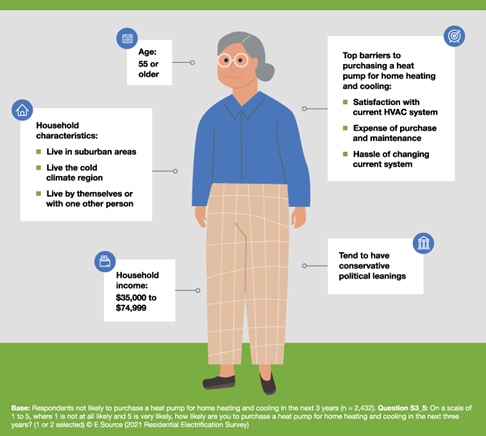

However, over 50% of our survey’s respondents aren’t likely to purchase a heat pump in the next three years. They’re older and more conservative, and they live in suburban areas. They’re also likely to be single or live with one other person (figure 2).

Figure 2: Characteristics of customers not likely to buy a heat pump

While they’re not early adopters, they’re likely a neighbor or acquaintance of early adopters. Keep these customers in mind for your future heat pump programs, but don’t focus on them yet.

How to put market research insights into action

If you’re trying to create equitable electrification programs to offer to all of your customers in your service area, knowing their characteristics and behaviors is crucial in developing custom solutions that will speak to—and be feasible for—each individual.

To enhance relationships with the community, achieve the next generation of savings, and lead the carbon-reduction effort, utilities need to think differently, make data useful, and learn from the best strategies across the industry.

Let our research give you the insight you need to meet your goals, whether customer-facing or operational. Our proprietary, industry-specific market research, benchmarking studies, and assessments can enhance your programs and customer interactions by giving you a deeper understanding of customers’ needs, behaviors, and beliefs. You’ll also learn how your utility compares to its peers and how to improve your outcomes.

If you’re interested in other ways you can use data or ethnographic research to improve equity, read our E Source E News article Understanding low- and moderate-income customers’ needs through data science and ethnography. And to learn how we can help with your equity initiatives, visit our Energy equity web page.