While still a new concept to some, more and more utilities are offering battery storage programs to their customers as market opportunities grow. After all, the US Energy Information Administration reported that the US had 402 megawatts (MW) of installed small-scale battery storage capacity in 2019. Customer demand for battery storage systems is increasing because of reliability challenges from severe weather as well as the falling costs of battery systems. We expect these numbers to continue to grow as more utilities and service providers become proficient in offering the technology.

The freedom of choice is also becoming more prevalent. End users can now choose to get their battery system from a third-party provider or, if offered, rent it from their utility. This is a great opportunity for utilities to engage with their customers on nontraditional service offerings.

With program offerings continuing to expand, the potential for a battery program is great. Some utilities are already on board and are setting the pace. The number of pilots and programs for utility-owned batteries has increased impressively even since 2020.

So, what kinds of programs are these utilities offering, and how are they getting buy-in from customers?

Established battery incentive structures

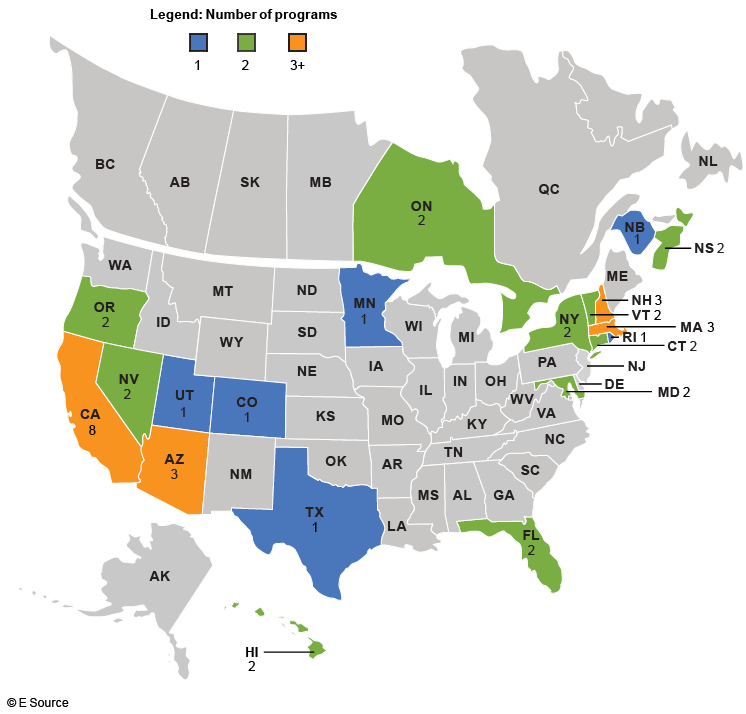

We’ve identified 28 utilities in the US and Canada that offer a total of 42 pilots or programs featuring battery storage technologies (figure 1).

Figure 1: States and provinces offering battery storage programs

Naturally, the amount and type of incentives vary from program to program. As we explained in the recent blog post Designing a battery incentive that benefits customers, utilities, and the rate base, utilities tend to set incentive levels based on avoided costs, so they vary by region and by program intent.

Some utilities are offering residential customers one-time credits of $100 to $1,000. Arizona Public Service (APS), for example, offers a one-time $500 bill credit. Hawaiian Electric Co., offer free devices and installation in addition to monthly bill credits for exporting energy to the grid during certain hours of the day. Eversource offers discounts seasonally—$225 in summer and $50 in winter, per average kilowatt (kW) used by the utility per demand-response event. Sacramento Municipal Utility District offers incentives for customer-owned systems on a sliding scale, based on storage size: $600 for a 15-to-30-kW system; $1,000 for a 30.1-to-75-kW system; and so forth.

Growth in utility-owned battery systems

Even with all these incentives in place, the up-front cost of purchasing a battery storage system is high. We researched what a handful of utilities are doing to increase uptake of utility battery programs and found a new trend in which the ownership structure is changing from customer-owned systems to utility-owned.

By offering the battery system (sometimes along with installation and ongoing maintenance), utilities are boosting enrollment among customers who are attracted to the program’s benefits and appreciate the hands-off approach of essentially renting a system provided by the utility.

This is the case for at least 6 of the 12 utilities we included in our recent research on this topic, including APS, Green Mountain Power, Liberty Utilities, and Portland General Electric.

Members of the Distributed Energy Resource Strategy Service can find out more about how utilities are engaging their residential customers with battery programs in the report How are utilities getting residential customers on board with battery storage?