Contents

How do we calculate VOC maturity?

How mature are utilities’ VOC programs?

VOC management is the cornerstone of an effective customer experience (CX) program. It can help you develop a real understanding of your customers, build momentum for CX, cultivate trust with customers, engage employees, and more.

Our research from the E Source 2020 Customer Experience Survey reveals there isn’t a singular approach to managing VOC data. Some utilities rigorously collect, analyze, act on, close the loop on, and share these insights. Others conduct surveys with no follow-up.

To understand VOC maturity among utilities, we evaluated the results of the Customer Experience Survey. We received responses from 20 utilities across the US and Canada, providing us with valuable insights on the maturity of VOC management.

How do we calculate VOC maturity?

Defining the disciplines and activities of VOC management

VOC management disciplines

We asked utilities about 46 VOC management activities. We’ve categorized them into five disciplines that contribute to an effective VOC program:

- Listen. Gather VOC data from solicited sources (surveys, focus groups, ethnographic research) to unsolicited (complaints, social media, call recordings), and from structured channels (closed-ended survey questions) to unstructured channels (chat transcripts).

- Analyze. Turn VOC data into insights that you can apply to manage CX.

- Act. Use VOC insights to manage CX or to embed a customer-centric focus in the organization.

- Close the loop. Respond to the customer and resolve any immediate issues they raise.

- Share. Make sure the organization is aware of, and engaged with, VOC information.

Turning survey data into a VOC maturity assessment

To transform utilities’ survey responses into an assessment of VOC maturity, we evaluated the data based on some guiding assumptions. First, we looked at the 46 VOC management activities and identified the most effective strategies (we go into more detail on these activities in the section Looking at VOC maturity by activity). Those include:

- Sharing VOC results with all employees on a weekly, monthly, or quarterly (rather than annual) basis

- Including a customer’s emotional response in transactional surveys

- Measuring and analyzing CSAT

For each of these positive strategies, we awarded 1 point to the utility, the activity, or the discipline. Then, we added together those points to rank the 20 responding utilities in VOC maturity. We also looked at how each activity ranked in popularity, and we ranked each of the five disciplines based on the percentage of points it received. If a strategy we considered effective was also included in corporate-level performance goals, we also gave points to those goals at the department, team, and individual levels.

How mature are utilities’ VOC programs?

Looking at VOC maturity by utility

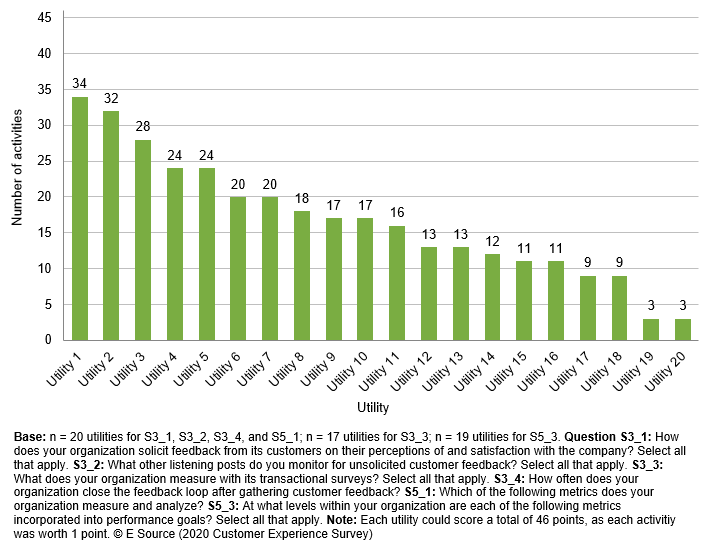

We saw a wide distribution of points among the 20 utility respondents (figure 1). Of a possible 46 points—each utility could earn 1 point per activity, with a total of 46 activities—the top utility in VOC maturity earned 34 points and the bottom utility earned only 3 points.

Figure 1: Ranking utilities according to VOC maturity

Looking at VOC maturity by discipline

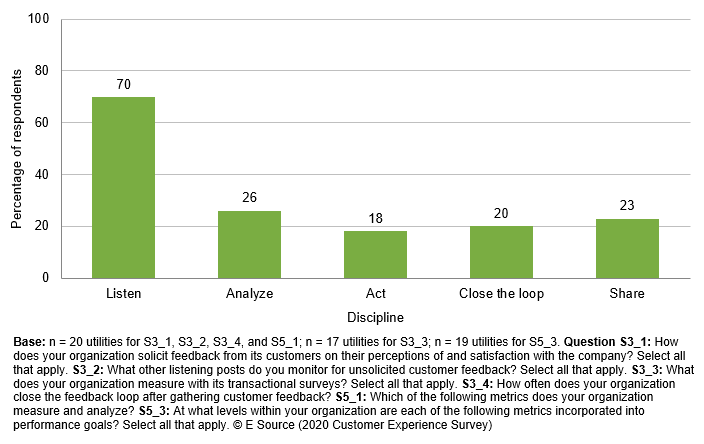

Utilities are spending more effort and resources on gathering VOC data than on analyzing it or acting on it (figure 2). Utilities have an opportunity to improve VOC management by analyzing the data they’ve gathered and using it to influence their CX management.

Figure 2: Listening is widespread, while other VOC disciplines are relatively uncommon

Looking at VOC maturity by activity

Analyzing VOC maturity by the 46 activities included in our survey allows us to understand how common various VOC management practices are among utilities. Nine of the 10 most common activities come from the listen discipline (figure 3). However, 1 of the top 10 activities—including CSAT in performance goals at least at the corporate level—comes from the act discipline.

Figure 3: Most utilities monitor complaints, social media, and calls and conduct surveys

| Discipline | Activity | Utilities that selected each activity |

|---|---|---|

| Base: n = 20 utilities for S3_1, S3_2, S3_4, and S5_1; n = 17 utilities for S3_3; n = 19 utilities for S5_3. Question S3_1: How does your organization solicit feedback from its customers on their perceptions of and satisfaction with the company? Select all that apply. S3_2: What other listening posts do you monitor for unsolicited customer feedback? Select all that apply. S3_3: What does your organization measure with its transactional surveys? Select all that apply. S3_4: How often does your organization close the feedback loop after gathering customer feedback? S5_1: Which of the following metrics does your organization measure and analyze? S5_3: At what levels within your organization are each of the following metrics incorporated into performance goals? Select all that apply. © E Source (2020 Customer Experience Survey) | ||

| Listen | Monitor complaints | 19 |

| Conduct relationship surveys | 18 | |

| Conduct transactional surveys | 17 | |

| Monitor social media | 17 | |

| Monitor and record calls | 17 | |

| Measure satisfaction with transaction via transactional surveys | 16 | |

| Monitor focus groups | 15 | |

| Monitor online customer panels | 15 | |

| Measure ease of completing transaction via transactional surveys | 15 | |

| Measure satisfaction with utility employee via transactional surveys | 13 | |

| Monitor email or chat transcripts | 11 | |

| Measure transactional completion via transactional surveys | 11 | |

| Gather qualitative ethnographic research | 7 | |

| Measure emotional response to transaction via transactional surveys | 5 | |

| Analyze | Measure and extensively analyze customer satisfaction (CSAT) | 12 |

| Measure and extensively analyze employee satisfaction | 9 | |

| Measure and extensively analyze first-call resolution | 7 | |

| Measure and extensively analyze self-service containment | 6 | |

| Measure and extensively analyze first-contact resolution | 5 | |

| Measure and extensively analyze Net Promoter Score (NPS) | 4 | |

| Measure and extensively analyze Customer Effort Score (CES) | 4 | |

| Measure and extensively analyze journey-based metrics | 3 | |

| Measure and extensively analyze vendor metrics | 1 | |

| Measure and extensively analyze in-house metrics | 0 | |

| Act | Incorporate CSAT into performance goals at least at the corporate level | 15 |

| Incorporate self-service containment into performance goals at least at the department level | 7 | |

| Incorporate employee satisfaction into performance goals at least at the corporate level | 6 | |

| Integrate feedback into strategy at least annually | 5 | |

| Incorporate NPS in performance goals at least at corporate level | 3 | |

| Integrate customer feedback into product development at least annually | 2 | |

| Integrate customer feedback into customer experience initiatives at least annually | 2 | |

| Incorporate first-call or first-contact resolution into performance goals at least at the corporate level | 2 | |

| Incorporate journey-based metrics into performance goals at least at the department level | 2 | |

| Integrate customer feedback into internal processes at least quarterly | 1 | |

| Integrate customer feedback into touchpoint improvements at least quarterly | 1 | |

| Incorporate CES into performance goals at least at the corporate level | 1 | |

| Incorporate in-house metrics into performance goals at least at the corporate level | 0 | |

| Close the loop | Recognize employees who receive positive feedback at least quarterly | 6 |

| Address employees who receive negative feedback at least quarterly | 6 | |

| Follow up in 48 hours with customers who have provided negative feedback | 4 | |

| Follow up in 48 hours with customers who have provided positive feedback | 0 | |

| Share | Share results with upper management at least quarterly | 9 |

| Share results with all employees at least quarterly | 5 | |

| Develop a plan for addressing feedback and share it with upper management at least quarterly | 4 | |

| Develop a plan for addressing feedback and share it with all employees at least quarterly | 3 | |

| Share results with all customers at least quarterly | 2 | |

How do you improve VOC at your utility?

Utilities have an opportunity to become more mature in their management of VOC data. While many have adopted survey tactics to gather the voice of the customer, far fewer utilities are using the information they’ve collected to produce insights and improve CX.

To gain VOC maturity:

- Listen: Incorporate unstructured feedback such as call recordings and survey comments into your VOC program for added depth and insights.

- Analyze: Conduct extensive driver analyses of your utility’s top CX metric to find areas you can improve.

- Act: Help program, product, and service development teams incorporate VOC insights.

- Close the loop: Follow up with employees who receive positive feedback.

- Share: Regularly share relevant VOC insights with all employees.

More resources on VOC

“Best practices for a successful VOC program” outlines strategies your utility can use to improve customer relationships.

The essentials for managing the voice of the employee offers tips on engaging and understanding your own employees, which you need to do to provide a stellar CX.