According to business consultancy Zenith’s Global Intelligence: Automotive Adspend Forecasts (PDF), in 2019, carmakers spent around $18 billion on advertising for all their vehicles, including their electric models. It’s hard to tease out what percentage of advertising budgets manufacturers are spending to promote plug-in electric vehicles (EVs), but it’s safe to assume it’s not much based on the sales numbers.

Aside from the Tesla Model 3, EVs aren’t flying off the showroom floor. Nissan Leaf sales have dropped from a peak of about 30,000 cars in 2014 to less than 13,000 cars in 2019. Ford sold 16,000 Fusion Energis in 2016, but slumped to 7,500 in 2019. And these are a couple of the more popular EVs.

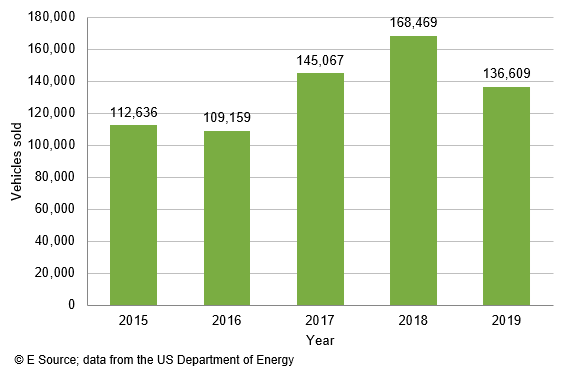

Figure 1 shows overall US EV sales outside of Tesla (ouch). In a 2018 University of California, Davis, study of Californians, 75% of respondents couldn’t name a single model of battery electric vehicle. Not exactly indicative of a robust marketplace. Good thing Tesla’s in the mix.

Figure 1: US non-Tesla plug-in EV sales, 2015–2019

Utilities have a great opportunity to aggressively promote EVs even though they don’t make them or sell them. Companies in other industries have taken this approach. For example, before disposable razors became the norm, Gillette basically gave away nice razors in order to sell the attachable blades—the part that would eventually have to be replaced and make the company money—and the razor maker invested heavily in advertising. Kodak and Polaroid both sold inexpensive cameras in order to sell film and developing services—a huge money-maker that they widely promoted. Similarly, utilities are the ongoing sales channel for electric fuel, so by powering the shift from internal combustion engines to EVs, they can reap the benefits from carbon reduction and electricity sales.

Utilities are the ongoing sales channel for electric fuel, so by powering the shift from internal combustion engines to EVs, they can reap the benefits from carbon reduction and electricity sales.

I’m likely explaining something you are already know, but we believe that utilities are uniquely positioned and qualified to be the primary promoter for electric transportation in these early stages of sales. Here’s why:

- Car companies are busy selling high-margin vehicles. Right now in the US, SUVs, crossovers, and trucks are the main focus for manufacturers. And they have little interest in promoting EVs. Maybe in a few years, when EVs look like money-makers instead of compliance cars, manufacturers can take over the marketing duties. But there’s no guarantee this will happen.

- Utilities are setting electric fuel prices. In addition to selling electric fuel, utilities are setting its price. Which leads me to my next point.

- Utilities are the only entity that can effectively manage the real-time grid. Utilities have a responsibility to maintain the grid, integrate renewables, and keep electricity rates low. Car companies have no interest in educating customers about these critical elements, but utilities have an opportunity to shine.

- Utility brands can make a giant leap forward. The vast majority of customers want their utility to be more environmentally friendly. They also want to shrink their own environmental impact. By promoting EVs as a way to help customers in this area, utilities can boost their brand image.

- It will help utilities’ bottom line. Growing the EV market is a great way to improve load factors if the cars are charged effectively. Utilities should be rewarded for keeping rates low, accelerating carbon reduction, and improving the local air quality.

I’m personally worried that EV sales won’t grow quickly enough to keep up with carbon goals. EV insiders often fall back on hopeful refrains like “When we have more models available …” or “We just need a good electric SUV and truck …” or the classic “When we have enough charging stations … .” Unfortunately, we might have a long wait ahead of us if we pin our hopes on these scenarios.

Utilities can play the vital role of promoting EVs now, using segmentation to reach the markets that are most ready for them, leveraging existing relationships with customers, and highlighting the clean-energy message that resonates so well with the public.

E Source can help you optimize your EV strategy and road map in so many ways, whether you need to find the best set of EV buyers, create marketing messages, segment your market, map your customers’ journey, forecast demand for EV charging, or understand the nuances of consumer barriers to adoption. As part of the Electric Vehicle Residential Customer Survey, we collected regional data to help utilities understand customers in their specific service territories. Contact us to learn more about how we can help you become an industry leader in EV marketing.