As state and federal policies continue to focus on building electrification, distributed energy resources (DERs), and EVs, utilities and regulators are exploring how to fund, justify, and evaluate these new programs. You’ve likely heard the terms performance-based regulation (PBR) and performance incentives thrown around as part of this conversation. While they sound similar, they aren’t necessarily interchangeable.

Let’s explore what each of these terms means and what the differences between them are.

What is utility performance?

Indulge me with a brief metaphorical detour. In any job or sector, the definition of performance evolves over time. For example, in the first year of your job, your performance might be based on how well you take direction, navigate your onboarding, and apply your skills to existing projects. But in the fifth year of your job, your performance is likely related to vision and strategy, mentorship, and your ability to identify and solve new challenges. Basically, how you define performance isn’t static through time. What does that mean when applied to utilities?

An early goal for utilities and regulators in the

Today, the way utilities may need to define performance is changing. In addition to ensuring safety and reliability, regulators often task utilities with achieving goals related to EVs, integration of renewables and DERs, and even customer satisfaction and equity. So, how do we incorporate these new performance metrics into the way utilities are regulated and compensated? Performance incentives and PBR are related—but distinct—options for doing this.

Performance incentive mechanisms (PIMs)

The traditional COS regulatory framework (paired with the fact that energy efficiency inherently reduces energy sales) created a historical disincentive for utilities to invest in efficiency. Regulators initially used PIMs (paired with other regulatory tools like decoupling) to help level the playing field by providing utilities with competitive monetary rewards to invest in energy efficiency. In this approach, utility revenue is still tied to the investment in capital infrastructure, but there is also money on the table for investing in energy efficiency.

PIMs reward utilities for meeting or attempting to meet stated energy efficiency goals. Or, less frequently, they incentivize going above and beyond typical energy-savings targets. Recently, utilities and their regulators have developed more ambitious and diversified PIMs that go beyond meeting energy efficiency targets. While PIMs can be used in any regulatory context, they’re strongest and most effective in a PBR approach where they explicitly tie utility earnings to performance.

Performance-based regulation

In PBR, PIMs become the benchmark by which utilities are measured and compensated instead of just an added bonus. This means that instead of earning financial returns for investing in new infrastructure, utilities are compensated for how they perform against stated goals. These goals are defined by the PIMs. As a result, jurisdictions with PBR must take care to develop strong, actionable PIMs that reward utilities for progress toward high-level, societal goals. It’s also important that utilities and regulators set PIMs that:

- Are clear and achievable

- Are reasonably within the utility’s control

- Include an agreed-upon method to measure the outcomes and results

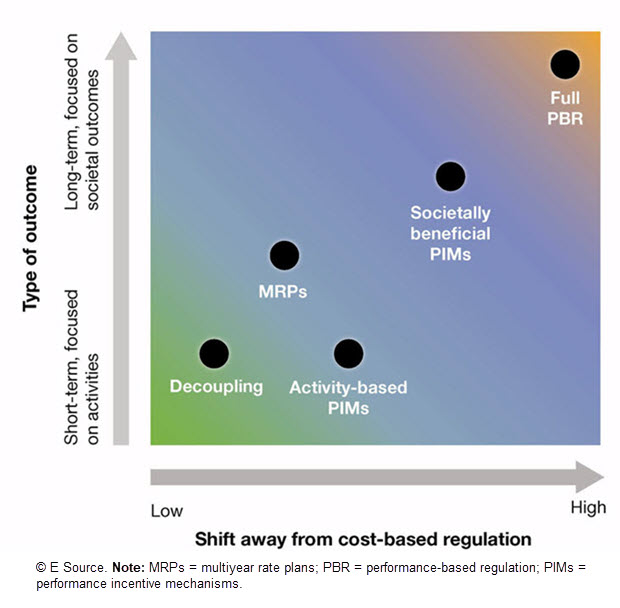

PIMs in a PBR context are also paired with other regulatory mechanisms, such as multiyear rate plans, to give the utility time (and revenue certainty) to innovate and achieve the goals. While PIMs in traditional regulatory frameworks are often short term and focused on distinct actions and activities, PIMs under PBR have a long-term focus on societal and policy outcomes (figure 1).

Figure 1: How PIMs and other regulatory mechanisms contribute to a shift away from cost-based regulation

The Rocky Mountain Institute reviewed policy priorities in seven states that have enacted PBR statutes since 2018 in its States Move Swiftly on Performance-Based Regulation to Achieve Policy Priorities report. Researchers found that the most common policy goals targeted by PBR are affordability and cost control, emissions reduction, and reliability. Our report Performance-based regulatory strategies to accelerate beneficial electrification discusses PBR in more detail and highlights case studies from Hawaii and Minnesota—some of the earlier US jurisdictions to explore PBR.

Utilities looking to dip a toe in the PBR water can consider deploying a mechanism known as tracking PIMs. Tracking PIMs can ease some of the risks for utilities by providing time to monitor potential PIMs before they become the primary path to financial compensation. Tracking PIMs can also be used in jurisdictions with established PBR frameworks to identify metrics that may become future PIMs. In Illinois, state legislation on performance-based ratemaking directed the commission to approve “reasonable and appropriate tracking metrics to collect and monitor data for the purpose of measuring and reporting utility performance and for establishing future performance metrics.”

It can be overwhelming to think about overhauling a decades-old regulatory framework and, perhaps unsurprisingly, there’s not a one size fits all solution for how to approach it.

Hawaii’s PBR framework took effect in June 2021 (PDF), and regulators will be evaluating utility performance with PIMs related to the state’s renewable energy goals; interconnection of DERs; grid services; and efforts related to low- and moderate-income customers. In addition to these core PIMs, the public utilities commission (PUC) decision also approved tracking PIMs called “Scorecards and Reported Metrics” to support future planning.

Why performance matters

It can be overwhelming to think about overhauling a decades-old regulatory framework. And, perhaps unsurprisingly, there’s no one-size-fits-all solution for how to approach it. In addition to PIMs and PBR, utilities can use other tools to better align their goals to societal and policy priorities. The National Standard Practice Manual for Benefit-Cost Analysis of DERs, for example, outlines how utilities can create a jurisdictional cost-effectiveness test that incorporates electrification, DERs, and equity.

In any case, it’s imperative that utilities work with their regulators to forge a path forward in this new and dynamic energy landscape. One notable benefit of a performance-based approach is that the PIMs aren’t static. They can be forward-looking and evolve in line with utility and policy goals. A performance-based approach also creates an opportunity for utilities and regulators to work collaboratively to develop PIMs that are both achievable and ambitious. In Illinois, the PUC can adjust the design, structure, and incentive level of PIMs and track metrics as needed at the end of each multiyear rate plan. Similarly, as outlined in the PBR press release, the Hawaii PUC commits to “continue to work with Hawaiian Electric and stakeholders throughout the multi-year period to explore additional PBR mechanisms to incent exceptional performance and support improved customer offerings.”

Regardless of the specific path, utilities should be prepared for ongoing conversations and collaboration with their regulators and other stakeholders to redefine modern utility performance and agree on the metrics with which it will be measured.