People often shop around for the cheapest gasoline in town. You can see them scanning gas station signs for the lowest per-gallon price. As the electric vehicle (EV) market matures, consumers are going to be sensitive how much it will cost to “fill up” their EVs.

To get a glimpse into their perceptions of cost, E Source asked utility customers in the US and Canada a series of pointed questions in the E Source 2020 Electric Vehicle Residential Customer Survey. Here we offer insights to help you improve consumers’ understanding of EVs through new messaging approaches. Additionally, these results can help utilities better plan their public charging network pricing and determine whether time-variable rates are attractive to EV owners and shoppers.

How can you improve charging and pricing communications?

Using data from this survey, utilities can give useful information to consumers contemplating the purchase of an EV. Some key messages to describe in simple terms to consumers include:

- Charging at home is easy, and if you drive less than 30 miles per day, you can charge with a regular 120-volt outlet available in most garages overnight. If you drive more than that, your utility can help you upgrade to a faster charger for a modest cost, after rebates.

- The fuel to drive an electric car is much cheaper than gasoline, saving you about 60% to 70% of your costs.

- The costs for charging at public stations can vary a lot, so check the local prices when filling up.

- Fast chargers can be very convenient and can fill up most batteries in 30 to 60 minutes. However, some studies have shown that frequent fast charger use accelerates battery degradation.

Do customers know how to charge an EV?

To start with, we discovered that few people understand the charging process and available types of charging. In the survey, E Source described the different types of charging that the EV industry typically refers to as Level 1, Level 2, and Level 3 or fast charging in layman’s terms. These levels are meaningless to most consumers. Yet, even with simple explanations, these are still difficult concepts to grasp, since a gallon of gas is so much easier to understand than a kilowatt (kW) or kilowatt-hour (kWh) for most consumers.

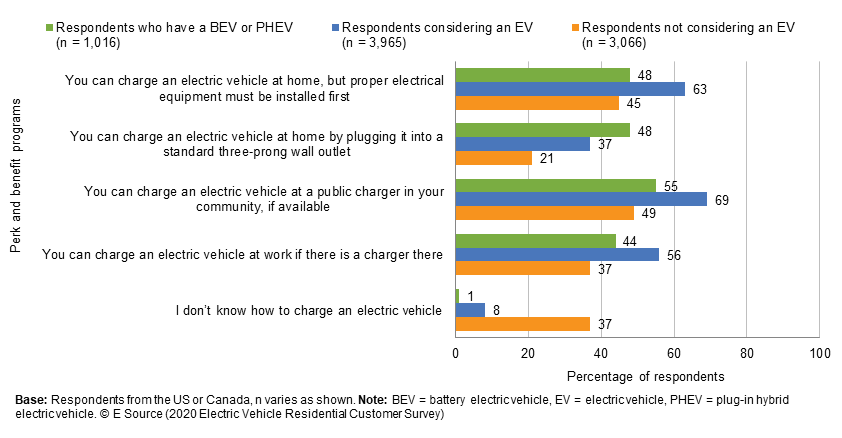

We asked questions about how EVs are charged, and the results aren’t encouraging regarding how our industry is messaging to consumers. Among those who already owned a battery electric vehicle (without a gasoline engine) or a plug-in hybrid EV (with batteries and a gasoline engine), only 48% believed it’s possible to charge their car with a regular 120 outlet that’s commonly available in a garage or near a driveway. Among those who were considering buying an EV, only 37% believe they can charge with a standard outlet (figure 1). Only 21% of those not considering buying an EV thought this was true.

Figure 1: How are EVs charged?

How much are customers willing to pay for public charging?

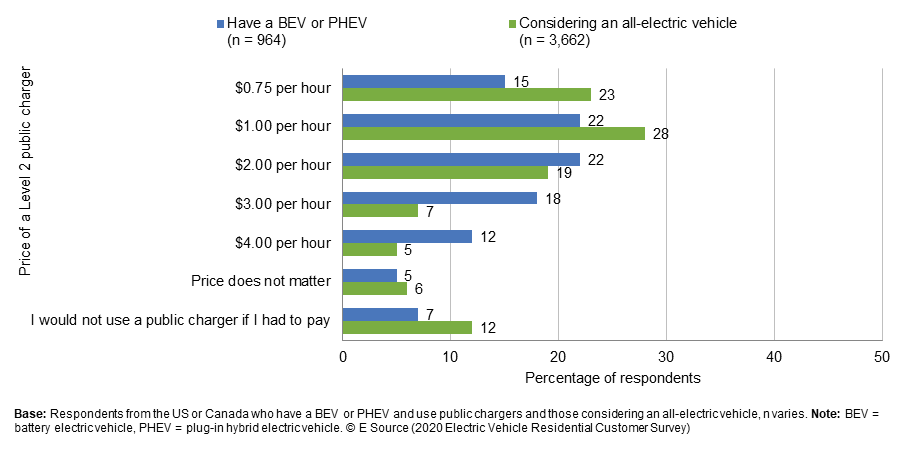

Level 2 charging. We surveyed respondents on their willingness to pay for different home and public charging options. For public Level 2 charging, we gave options for different prices per hour of charge, assuming a 6.6 kW charger. We asked respondents what the highest price they would pay for a public charger was, assuming they had a Level 2 charger at home that cost $0.75 per hour to use. Most EV owners were willing to pay up to $3 per hour (figure 2). Those considering an EV were more sensitive about the price. More than half said they would pay no more than $0.75 or $1.00 per hour, and only 5% said they’d pay $4.00 per hour.

Figure 2: Willingness to pay for public Level 2 charging

Fast charging or Level 3. We then asked about fast charging and their willingness to pay for the added speed, which we said fully changed most cars in 30 to 60 minutes. Without considering the extra cost, about 24% of EV owners or those considering an EV said they would use a fast charger every time they could, 59% would use it when convenient, and 15% would use it in an emergency.

Then we told them about the possibility of battery degradation when frequently using fast chargers. This simple addition dramatically shifted people’s stated frequency of use. Only 33% said they’d use it when convenient (down from 59%) and 45% said they’d only use it in an emergency (up from 15%). Accurate communications about battery life and degradation will be paramount as more people adopt this new technology.

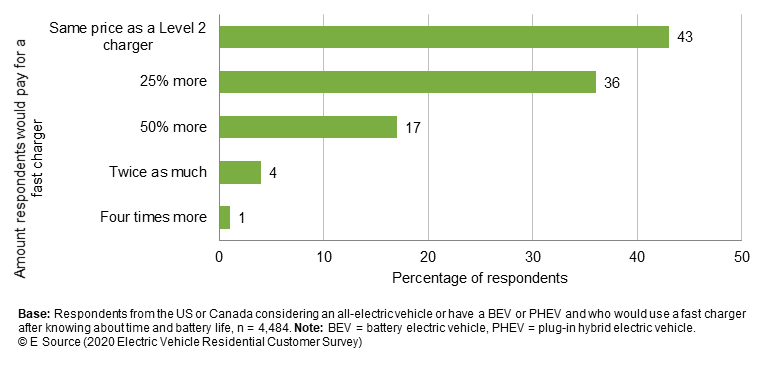

We then asked, “If you were using a public charger and had the choice between Level 2 and Level 3 fast charging, what was the most you would be willing to pay to use the fast charger?” Just over 40% of respondents said they’d only pay the same as the Level 2 (figure 3). On the other end of the spectrum, only 4% said they’d pay twice as much and 1% said they’d pay four times as much. This data could influence utility rates as well as private charging network companies who will have to pay significant demand charges and installation prices.

Figure 3: Willingness to pay for a fast charger

Would customers shift their charging habits at home to save money?

We first asked whether consumers would rather charge at their preferred time of day or save money by shifting their charging to a time of day when prices are cheaper. Surprisingly, 71% of EV owners said they wouldn’t shift even if they had to pay more. On the other hand, 65% those who are considering buying an EV would shift.

Why is there such a dramatic difference? We think there are two elements that could be influencing this result:

- People inevitably get into habits. EV owners are set in their ways and don’t want to change.

- Most EV owners own luxury vehicles (many Teslas) and are likely to be less price sensitive than the next generation of mainstream EV buyers.

For those who say they don’t want to shift, we challenged them to see how much more they would pay until they felt like it was worth it to change when they charge. Of this group:

- 82% would pay $20 more per month

- 57% would pay $40 per month

- 39% would pay $60 per month

- 33% would pay more than $60 per month

Do customers know how much it costs to charge an EV?

Because people are used to gasoline in their engines, most people know their approximate mpg and therefore their cost per gallon and mile. With Colorado gas prices, the typical sedan will go about 25 miles on $2.50. When we calculate local kWh prices along with the miles per kWh for an EV, that cost drops dramatically to about $1.00 per 25 miles. But do consumers know this?

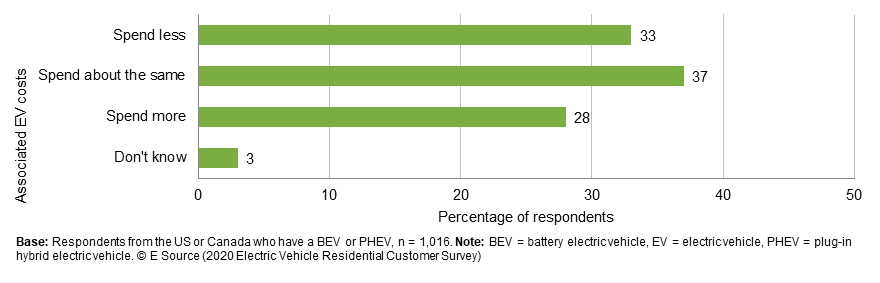

We asked current EV owners whether they were paying more, the same, or less for fuel with their EV (figure 4). The results are a bit shocking:

- 28% say they pay more for charging

- 37% say about the same as gas

- 33% say they spend less

Figure 4: Cost of charging compared to purchasing gas

Given that someone might drive across town to save $0.10 per gallon of gas, this seems to be a golden opportunity for utilities to tout the extremely low price of electricity as a fuel. Yet that message isn’t being relayed even to current EV drivers, so it’s unlikely potential buyers are getting the information.

In November 2021, the US passed the $1.75 trillion Infrastructure Investment and Jobs Act. The bill funds upgrades to American infrastructure, transportation, and energy systems, including $7.5 billion to help set up a national EV charging system. To learn about the return on investment for an EV charging system, read the EV Connect article Are Car Charging Stations Profitable?