Budget billing doesn’t just make bills more predictable—it also encourages customers to adopt other helpful billing options. Customers enrolled in budget billing are more likely to use paperless billing and autopay than those on standard billing programs. This increased participation can improve customer satisfaction, boost cash flow, and lower overall costs.

According to the E Source Customer Experience and Brand Perceptions dashboard, budget-billing participation correlates with significantly higher participation in paperless billing and autopay. The data, drawn from the 2025 Claritas Energy Behavior Track survey, shows that enrollment in paperless billing is 11 percentage points higher among electric and dual-fuel budget-billing customers than those on standard billing. While the gap for autopay is smaller, budget-billing participants still show 3 percentage points higher enrollment. Enrollment gaps are present among gas customers as well.

Electric and dual-fuel customer enrollment rates in paperless billing and autopay

Gas customer enrollment rates in paperless billing and autopay

Budget billing tackles some of the biggest barriers to participation we’ve heard from customers, including:

- Using a paper bill as a physical reminder to pay

- Needing more control over when funds are withdrawn, especially after a high bill

To maximize benefits for both customers and your utility, consider offering these options as a program bundle that helps customers have a low-effort, predictable billing experience. But be sure to allow for individual preferences—some customers, especially those with strict budgets, may still want to initiate payments themselves or read through a paper bill each month.

Budget-billing customers report higher customer satisfaction

Beyond helping utilities increase enrollment in paperless billing and autopay, budget-billing participation is associated with higher customer satisfaction. In our Customer Experience and Brand Perceptions dashboard, we found that 28% of budget-billing customers rated their utility as “excellent,” compared to 23% of standard billing customers and 24% overall.

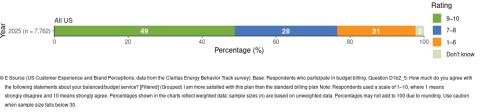

Seventy-seven percent of budget-billing customers also agreed with the statement “I am more satisfied with this plan than the standard billing plan.”

Satisfaction with budget billing versus standard billing plans

Keep in mind, though, that 23% of customers were neutral or disagreed with that statement. This shows that budget-billing programs have room for improvement and may not be the right fit for every customer. The E Source report How to design your budget-billing program with success in mind offers recommendations for improving your program.

Budget billing improves utility operations

Budget billing can also drive operational benefits. By encouraging greater participation in paperless billing and autopay, utilities can improve operations, reduce costs, and collect payments more reliably. Here are five utility-side benefits of enrolling customers in these programs:

- Lower costs from administration, collections, disconnections, and paper billing

- Fewer billing and payment-related calls to the contact center—both from customers calling to make a payment and confirming the payments were successful

- Fewer late or missed payments

- Increased use of other digital and self-service options

- Higher customer satisfaction and engagement

Want to explore more voice-of-the-customer insights?

Members of E Source Customer Experience Design & Strategy, Digital Self-Service, and Corporate Communications Service now have access to the Customer Experience and Brand Perceptions dashboard.

This tool consolidates data from our annual study conducted in partnership with Claritas to help you learn what over 30,000 residential US customers think about their utility, online experience, billing and payment preferences, and more.