What COVID meant, and means, for home upgrades in 2021

Contents

What we found in our COVID-19 Residential Survey

What you can do to serve customers who are interested in upgrades

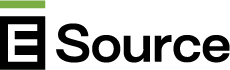

In May 2020, people in the US and Canada who responded to the E Source COVID-19 Residential Survey reported that they were delaying all types of home upgrades due to the pandemic. When we conducted the survey again in February 2021, we found that more respondents are planning to make upgrades in 2021 than 2020 (figure 1). But respondents are still delaying projects until later in the year. Customers may be more willing to make upgrades in 2021 as vaccines become more available in the US and authorities lift COVID-19 restrictions.

Figure 1: Which upgrades respondents’ planned or plan to complete in 2020 and 2021

It’s important that you convert those customers who plan to make upgrades into program participants. Our survey found that 25% of respondents still plan to complete at least one upgrade in 2021. We also found that 18% of all respondents have already made an upgrade this year. This may mean that more of your customers are interested in making upgrades now. Engaging each customer segment with the right program strategy will help you increase program participation and hit your energy savings targets.

To help you find these customers and enroll them in your programs, we analyzed survey data and compiled our recommendations.

What we found in our COVID-19 Residential Survey

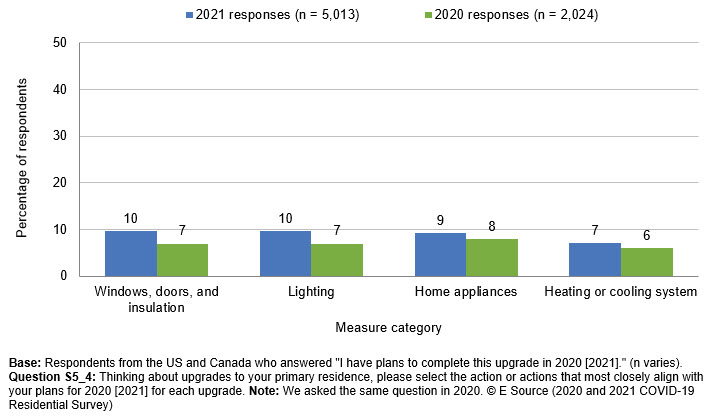

Respondents are still delaying home upgrades in 2021 because of COVID-19

Although more respondents are planning home upgrades this year, they’re still delaying upgrades at similar rates because of the pandemic (figure 2). At least 10% of respondents reported delaying an upgrade in 2021. Because people are delaying their planned upgrades, you should expect a spike in customer program participation toward the end of the year as long as vaccination rates continue to increase and COVID-19 cases decline in the US and Canada.

Figure 2: Respondents delaying upgrades due to COVID-19 in 2020 and 2021

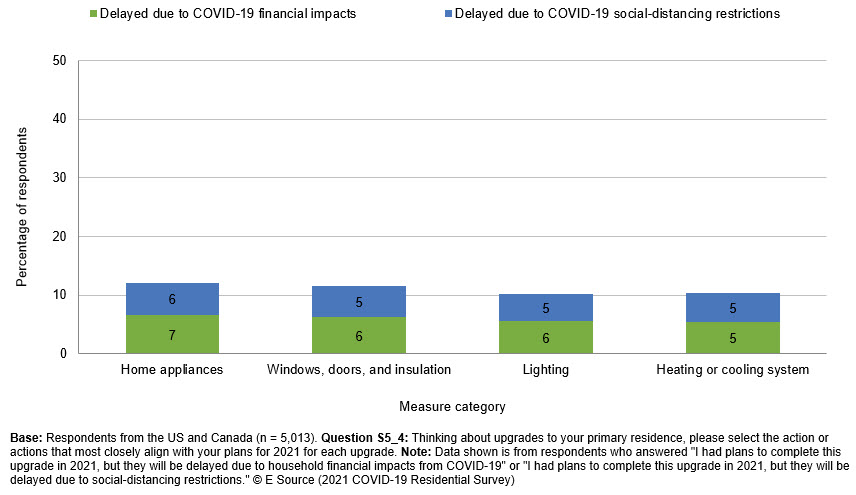

Respondents whose income increased during the pandemic made upgrades

In the 2021 COVID-19 Residential Survey, 29% of respondents whose household income had increased during the pandemic reported that they’ve already completed an upgrade this year. This group is more likely to have already made upgrades than those who have lost all their income, who saw their income decrease, or whose income stayed the same (figure 3).

Figure 3: How income affected respondents’ 2021 home upgrades

Consider marketing programs to customers whose income increased during the pandemic. But you should make sure that your messaging is still sensitive to customers who are struggling financially and can’t afford to make upgrades yet.

Respondents whose income stayed the same or decreased during the pandemic (including those who lost all income) were most likely to report making upgrades to home appliances and lighting. This might be because appliance and lighting upgrades tend to be cheaper than HVAC or envelope upgrades.

Sustaining Families and Striving Singles are still the most likely to complete home upgrades in 2021

Our survey revealed that 25% of respondents plan on completing at least one home upgrade before the end of 2021. To help you identify who those customers are, we generated national index scores for Claritas PRIZM Premier lifestage groups. An index score shows a group’s likelihood to do or be something compared to an average of 100. An index score of 300 means a segment is three times as likely to do or be something. And a lifestage group is a collection of segments with similar ages, incomes, and number of children.

The Striving Singles and Sustaining Families groups indexed higher than average for planning at least one upgrade in 2021. Consider these segments and their characteristics when developing marketing campaigns for your energy-efficiency rebate and incentive programs.

What you can do to serve customers who are interested in upgrades

Offer virtual and hybrid program options for customers throughout and after the pandemic

As the pandemic continues to impact your customers financially, and as some COVID-19 restrictions remain in place, we recommend offering virtual or hybrid upgrade options. The hybrid approach allows you to minimize time spent in customer homes for safety while still saving energy. After a virtual assessment, you can mail customers energy kits or allow contractors to install upgrades with enhanced safety requirements. Learn more about how other utilities have successfully implemented a hybrid residential program model during COVID-19 in our report >Why hybrid residential direct-install programs work during COVID-19 and are here to stay.

Use targeted messaging to market programs to the right customers and be sensitive to those who are still struggling

As we enter the next phase of the pandemic, some customers will be willing and able to participate in programs again, while others are still struggling financially because of COVID-19. You should use specific marketing and messaging for each customer segment to meet their unique needs. To learn about other utilities’ summer marketing and communications plans and how they’re adapting COVID-related messaging watch the >Exchange: The next phase of COVID-19 marketing and communications. You can also read about the next phase in our report >The next phase of COVID-19 communication strategies.