DSM Budget Trends Through 2020

As state and federal energy-efficiency policies are changing and measure baselines are rising, utilities are shifting their demand-side management (DSM) budgets to find more cost-effective savings opportunities. To understand how DSM budgets are changing, we analyzed planned utility budgets from 2016 to 2020, using E Source DSM Insights, and we found:

- Utilities are allocating more of their budget to administrative spending

- Customer incentives still make up the biggest portion of the budget

- Utilities are shifting budgets from residential to nonresidential programs

These trends are consistent with what we’ve been hearing from utilities as they address cost-effectiveness challenges due to rising baselines, most notably changes from the Energy Independence and Security Act of 2007 (EISA)—for more information, see our blog post Preparing Your DSM Portfolio for EISA Uncertainty. Residential lighting measures are most affected by EISA, and many utilities are shifting their focus toward commercial savings opportunities to make up for the lost residential savings. As a result, utilities are testing new, more-expensive program models that come with higher administrative costs, such as pay-for-performance programs—which track energy savings using real-time monitoring data.

At the Spring 2019 E Source DSM Executive Council in Boston, a few attendees shared that contractor payments have moved into administrative spending, which has increased administrative costs. Overall, the DSM budgeting process is inconsistent across organizations, which makes it challenging to provide a comparison.

Utilities are allocating more of their budget to administrative spending

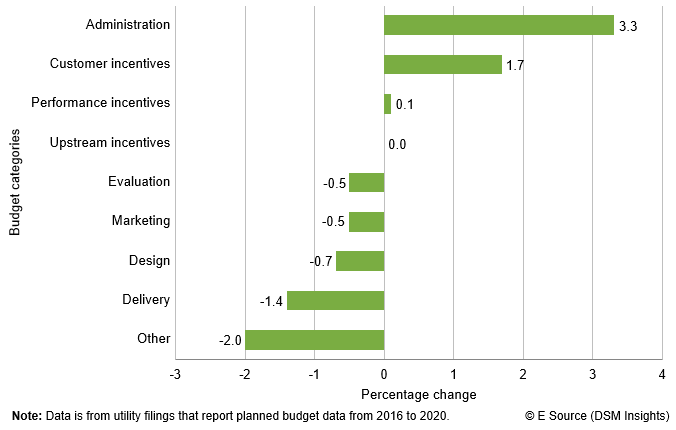

Looking at all available budgets from 2016 to 2020 in DSM Insights, we found that utilities are increasing the percentage of budget allocated to administration and customer incentives by 3.3% and 1.7%, respectively (figure 1). They’re also decreasing the percentage of total budget spent on delivery.

Figure 1: Utilities shift funding into the administrative budget category

Customer incentives still make up the biggest portion of the budget

In 2020, the average planned DSM budget is primarily composed of incentives, administration, and delivery (figure 2).

Figure 2: The utility budget of 2020

| Budget category | Percentage of budget |

|---|---|

| Note: Percentages may not equal 100 due to rounding. | © E Source (DSM Insights) |

| Customer incentives | 60.8 |

| Admin | 24.4 |

| Delivery | 12.0 |

| Evaluation | 1.0 |

| Marketing | 0.9 |

| Design | 0.2 |

| Utility performance incentives | 0.2 |

| Other | 0.4 |

Utilities are shifting budgets from residential to nonresidential programs

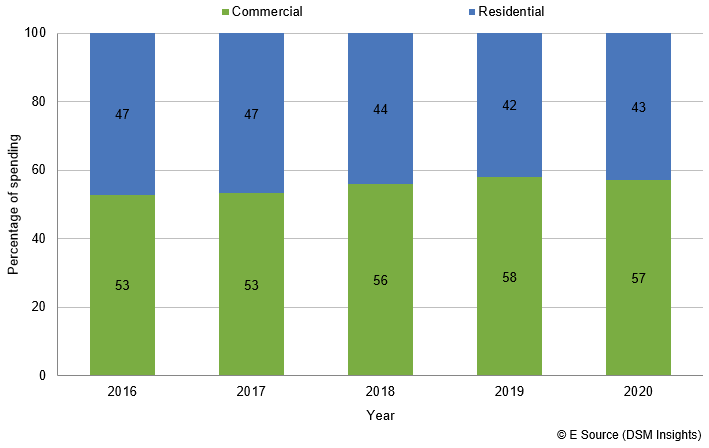

For electric efficiency programs, we identified a 4% swing from residential to commercial sector spending for utilities with planned data for 2016 to 2020 (figure 3). Planned commercial sector spending will increase from 53% to 57% of DSM budgets, while residential sector spending will decrease from 47% to 43%.

Figure 3: Utilities are spending more on nonresidential electric efficiency programs

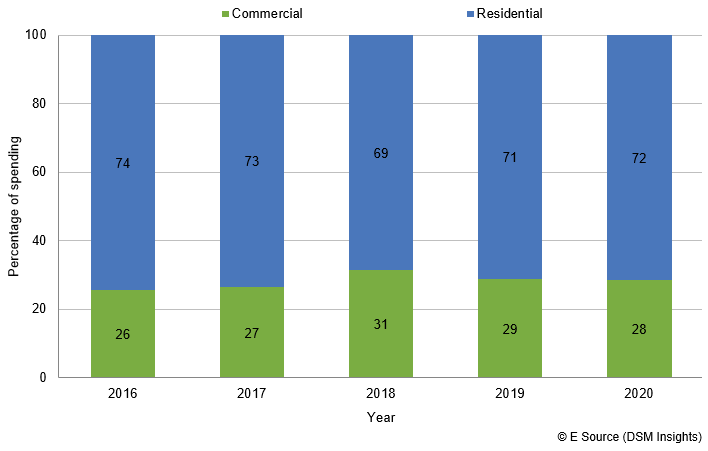

For gas efficiency programs, we identified a 2% swing from residential to commercial sector spending for utilities with planned data for 2016 to 2020 (figure 4). Planned commercial sector spending will increase from 26% to 28% of DSM budgets, while residential sector spending will decrease from 74% to 72%.